A chilling tale has gripped social media after a Nigerian man shared the story of a woman who reportedly suffered a debilitating stroke while holding contribution money, rendering her unable to speak or manage the funds. The incident, which has sparked widespread conversation on X (formerly Twitter), has left many questioning the risks associated with informal savings schemes.

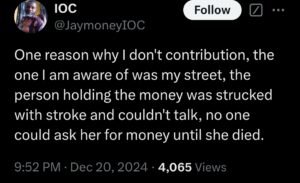

The man, in his viral post, revealed that the woman’s sudden illness left the entire community in limbo. Her inability to communicate meant no one could access the pooled funds, leaving contributors stranded. “The one I know on my street, the person holding the money was struck by a stroke and couldn’t talk. No one could ask her for money until she passed away,” he wrote, highlighting the unforeseen challenges of such arrangements.

The story has drawn a wave of reactions online, with users recounting similar experiences of tragedies tied to money management in informal setups. One commenter recounted a chilling incident involving a woman killed over similar funds, while others shared their distrust of such arrangements, labeling them as risky and unpredictable.

This incident underscores the importance of accountability and safety in collective financial practices, especially in a country where informal contribution systems remain a popular means of savings. For many Nigerians, such methods are a lifeline in the absence of formal banking access, yet stories like this reveal the potential pitfalls when tragedy strikes.

The viral post has also reignited conversations about trust, transparency, and the need for regulated systems that can protect contributors from unforeseen losses. While some social media users resorted to humor to lighten the gravity of the situation, the underlying concerns remain profound, as many seek ways to safeguard their hard-earned money.

As this story continues to make waves, it serves as a stark reminder of the fragility of life and the challenges of managing collective resources in times of crisis. For those involved in similar schemes, the message is clear: safeguards and contingency plans are not just optional—they are essential.

SEE POST: